Understanding the Future of the RAN Intelligent Controller

Open RAN advocates understand the tremendous value of the RAN Intelligent Controller (RIC) for CSPs, and the industry buzz is spreading. In fact, the non-Real-Time (non-RT) version (often confused with SON as it could have similar functionality) is growing to a healthy percentage of the overall RAN market (Mobile Experts). Although much of that growth is predicted for “greenfield” networks, there is significant opportunity to grow into the “brownfield” market of large Tier 1 CSPs rather quickly.

To help mobile operators make the best use of network resources, the RIC, which in two constituent parts is the non-RT and the near-Real Time (near-RT) RIC, is designed with deep knowledge of the Radio Access Network (RAN) domain, Artificial Intelligence and Machine Learning (AI/ML), and cloud-native, software-defined networking.

But is there alignment on what constitutes a RIC? The non-RT RIC is often confused with existing SON platforms. Some vendors are just adding or modifying their existing interface to represent the O- interface from O-RAN Alliance standards to their “closed” RAN, and calling it a RIC.

However, the real key to unlocking the value of the RIC is having O-RAN’s CU/DUs with both the O- and E2- interface capabilities. Without this, CSPs don’t get the true near real time RAN optimization and cost advantages of RIC– instead, what is positioned is a solution that is nothing more than a variant of legacy SON.

The RIC market is really just starting to come into place in the second half of 2022, with equipment going into trials. xApps will quickly come on the heels of RIC deployments.

The xApps are applications designed to run on the RIC platform to allow the near-RT RIC to optimize the radio resource management decisions for control-plane and user-plane functionalities across the layers of the RAN protocol stack on a per-user level. Each xApp offers radio resource management solutions to optimize specific RAN functionalities using data-powered AI and analytics tools and the incorporation of machine learning.

The Time is NOW

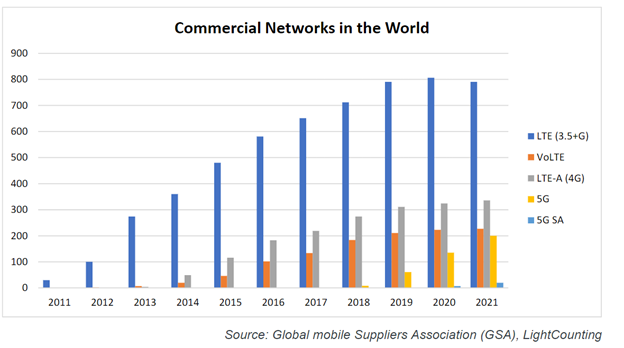

How do brownfield deployments of RIC really help CSPs who may otherwise have plans to wait for RIC until 6G or beyond? In the case of ATT, it was recently estimated it could save $1.6B a year by just turning off 4G/5G base stations at night. Adding intelligence using AI and the RIC to turn base stations off when not being used could add even greater savings. If this proves true, there will be a global push to present RIC into 4G/5G networks, and it will be a catalyst to get antiquated equipment or proprietary closed RAN equipment out of the network. In fact, research firm Light Counting recently said there is very little pure 5G out there and 4G/5G is still the focus.

Increasingly, Operators are looking at developing cloud-native functions to help wider corporate efforts integrating the DevOps process, removing vendor dependency and lock-in and providing more flexible deployment, management, configuration and operations of services.

Some experts argue that there is a need for a generational cycle (such as 6G) of big cloud-native network deployments to roll out to really see the impact of RIC. 6G might not be the answer though or for that matter, even happen?

There are enough Open RAN disruptors in the market today for RIC to have an economic impact. This is also why RIC may be the accelerator of Open RAN. If one can run an AI-powered xApp with Traffic Steering functionality to double the density of a cell site – it is too compelling of a proposition to ignore. This is why the xApps, built with a multi-vendor ecosystem, have significance, and the market for them will be fueled by their coupling with the O-RAN Alliance specified RIC.

The RIC platform, xApps, and rApps are the main contributors of TCO Savings, but the real benefit can only be achieved when coupled with O and E2 interfaces at the edge that are specified in the O-RAN alliance CU/DU.

Stronger Together

In my recent discussion with Joe Madden from Mobile Experts, he commented that he has a “working thesis on open vs. closed fronthaul capacity – and it is showing that, with xApps, Open RAN appears to have the potential for better performance with multiple vendors participating vs. that of just one closed vendor.”

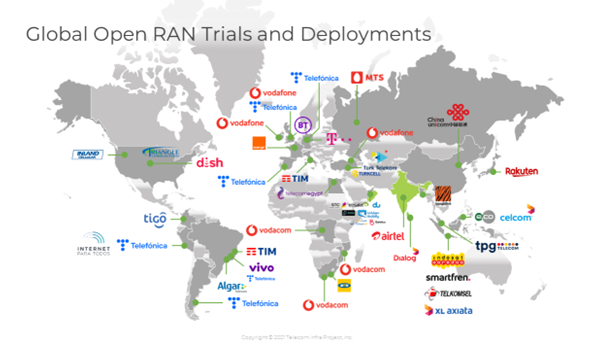

Vendor diversification is underway and interoperability has now been proven. The doubters are still there but the facts are undeniable. There are now new vendors in the RAN with Open RAN including Mavenir, NEC, Samsung, Fujitsu, Rakuten, MTI, Capgemini, Radisys, Dell, Intel plus others that were previously unable to participate in the proprietary world. And real Open RAN networks are being launched, including Dish and Triangle in USA.

Open RAN continues to gain momentum (TelecomInfraProject (TIP), 06/22) and new vendors will continue to take market share, especially as innovations like the RIC provide economic lift for CSPs.