Delivering the Multi-Cloud-Native Future at Hyperscale

The ongoing transition to cloud-native network functions – and the accelerating migration of these workloads to hybrid cloud environments – sits at the very heart of telecoms industry digital transformation today.

A new Executive Briefing report from telecoms consultancy and research firm STL Partners highlights how effective partnerships between network solution vendors and hyperscale cloud providers (such as AWS, Microsoft Azure and Google Cloud) are now central to delivering successful telco transformation at scale – creating the opportunity for both vendors and telcos to fundamentally reimagine established business relationships. The synergy of interests that exist between telcos, vendors and hyperscalers to facilitate the transition to public and private cloud-centric operations has already seen significant partnerships forged to ensure that vendors’ platforms are public cloud-ready.

In this blog, we summarize this comprehensive report’s key takeaways, including STL’s analysis of Mavenir’s collaborations with hyperscalers such as AWS, and its assessment of Mavenir’s leadership in making any-cloud, network-critical Open RAN cloud deployments for telecoms operators a commercial reality.

1. Vendors and Hyperscalers Want Telcos to Succeed in the Cloud

Telcos, vendors and hyperscalers have complementary roles to play in the emergent networked economy, as interdependent partners in what STL is coining the new Network-as-a-Service – NaaS 2.0 – ecosystem. Every party in this value chain wants telcos to succeed in making the transition to delivering services via cloud-native software, run in part or whole in the public cloud.

As network functions have become software-based, telcos have explored how to harness opportunities to generate new revenues through the ability to program and customize network functions around the needs of different verticals, plus those of developers of connectivity-dependent applications. Telcos are now looking to their vendor partners and other third parties – from systems integrators to cloud platform providers – to support their migration to cloud-centric operations and deployment of multi-vendor cloud-native network functions (CNFs) on horizontal telco cloud platforms.

In the context of this cloudification of network functions and infrastructure, hyperscalers have focused on providing network functions, platforms and services on an on-demand and SaaS basis, as well as providing telco cloud infrastructure – the virtual and physical cloud layer via Infrastructure-as-a-Service (IaaS). For hyperscalers to succeed, vendors need to deliver open, cloud-native, disaggregated network function software and telco cloud infrastructure, and adapt it to run on their clouds.

With all leading network equipment vendors now responding to the trend towards open, multi-vendor, disaggregated and cloud-native networks, vendors have a clear interest in supporting telcos’ evolution to cloud and software-based operations and service delivery. This includes both transforming telcos’ own networks and infrastructure (private telco cloud) and enabling telcos to deliver services via the public cloud.

2. Operators Should Embrace the Emerging Coordination Age

The transformation of telcos into successful cloud-native and hybrid cloud-based service providers calls for a radical overhaul of their core business and even identity. Evolving into providers of software-based network services over any cloud means telcos leaving behind their traditional business model and mission. Increasingly, the true value that connectivity has the potential to unlock lies with the applications and real-world use cases enabled.

In STL’s “three ages” of telecoms, telcos have remained largely in the first age – the Communications Age of utility communications and connectivity service provision. Having been cut out of the value chain by web-based providers of content and communications in the second “Information Age”, there is now an existential impetus for telcos to fully exploit the opportunities presented by the “Coordination Age”. This emerging third age will see networking itself evolve into a software-based product delivered over “the cloud” – encompassing a vast network of virtual and physical nodes that will power the connected real-world, industrial and social applications of a new AI-driven era.

3. Equal Partners in AI-Driven Application Networking

In the Coordination Age, interdependent, distributed compute application software and network software and workloads are likely to drive the autonomous, intelligent technology services and use cases of the future.

STL believes that networking is on the cusp of evolving into a business characterized by AI-driven, on-demand and bespoke network services delivered over any physical infrastructure, and over multi-cloud/any cloud (or “open cloud”). STL’s NaaS 2.0 vision is of bespoke, application-enabling and application-specific on-demand connectivity – and it believes that this is where future value growth will be generated in the industry.

STL further predicts that the rapid development of AI and gen AI will require programmable networking technology of a new order: one where it is no longer possible to treat network-function software and application software as distinct from one another.

With these potential changes come radical new and mutually interdependent roles for vendors, hyperscalers and telcos, which could play out as follows:

- Vendors become application-networking technology providers.

- Hyperscalers become application-networking compute infrastructure providers.

- Telcos become application-networking operators and service providers.

In short, hyperscalers provide the infrastructure and the platform, while network service providers (telcos and others) operationalize, commercialize and deliver those services in the physical world – via both virtual and physical network technology developed by vendors.

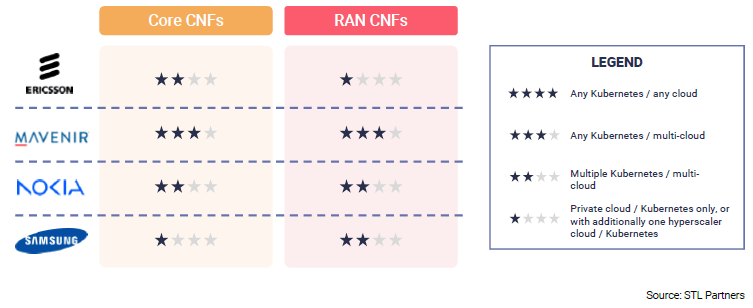

4. Focus on Mavenir: Delivering CNFs Across Any Cloud

STL emphasizes in its report that “Overall, Mavenir has made the most progress towards supporting multi-cloud CNF deployments for telecoms operators.” It also states that Mavenir can “lay claim to one of the few scaled deployments to date of CNFs on the public cloud” with its role in delivering US greenfield operator DISH Network’s Open RAN network. This landmark deployment provides “a real-world example of running demanding network workloads at scale over the public cloud.”

Highlighting Mavenir’s achievements, STL draws particular attention to:

- The integration of Mavenir Open RAN and 5G core with AWS, supporting private networking and edge compute.

- Successful Proof of Concept with AWS, Deutsche Telekom and VMware: this PoC involved running an AI-based video analytics application across an enterprise WAN connecting campus networks in Prague and Seattle via the AWS backbone. The campus networks hosted private 5G networks based on Mavenir Open RAN and 5G SA cores, operated by Deutsche Telekom over the AWS Integrated Private Wireless Platform.

- Mavenir’s status as core vendor partner in AWS’s Telco Network Builder private network-as-a-service platform.

- Scaled, hybrid Open RAN deployment on AWS as part of US operator DISH’s greenfield network.

Mavenir’s hyperscaler strategy is designed to provide fully cloud-native NFs that can be deployed and operated across any cloud or combination of clouds, private or public. In addition to being a vendor partner in Google Cloud’s Cloud RAN solution, Mavenir has developed a strong partnership with AWS, culminating in a five-year strategic collaboration to pre-test and pre-integrate Mavenir’s core and RAN CNFs to deliver telco-grade performance on the AWS cloud.

In 2021, Mavenir first announced the integration of its Open RAN and converged 4G and 5G core – plus IP Multimedia Subsystem (IMS) and messaging – with Amazon EKS Anywhere (supporting AWS Outposts). STL references the solution’s integration with a digital app store for enterprise and industry applications such as Intelligent Virtual Agents (IVA), AR/VR, industrial IoT, and robotics control, along with an edge AI application suite, emphasizing that “Mavenir’s platform is genuinely open and designed to support telcos in developing their own use cases together with ecosystem partners.”

5. Next Moves: Accelerating Transition to Cloud-Native and Open Cloud

The report concludes that, for many telcos, their cloudification journey has so far been limited to building more cost-efficient, scalable and programmable connectivity to reduce opex and capex, and to providing a platform for innovation and the possibility of becoming techcos. Migration to public and hybrid cloud, conversely, has been viewed chiefly in terms of supporting resilience and one-off or on-demand use cases.

STL believes, however, that the rapid development of AI and generative AI will demand programmable networking technology of a totally new order – one where network-function software and application software are no longer regarded as distinct, and with the network itself becoming an integral part of applications.

This AI-driven transformation will change the entire mission for telcos from one of providing connectivity over infrastructure (which can be adaptable, via APIs, to the requirements of apps – mainly third party-developed) to providing on-demand, bespoke application-networking services over any cloud (primarily owned by third parties).

Moving towards such a radically reimagined mission will require a deep change of mindset for telcos, in tandem with technological and organizational transformation. Vendors and hyperscalers now have a critical role to play in delivering on the promise of the NaaS 2.0 economy, and in helping telcos to reposition themselves to maximize their gains in this new cloud-native, inter-cloud and AI-native world.

Find more detail from STL’s analysis here.

*Blog by Bejoy Pankajakshan, EVP, Chief Technology and Strategy Officer at Mavenir