A Discussion of the Current Status of the Open RAN Market

*Guest Blog by Scott Bicheno, Editorial Director of Telecoms.com

At the recent Mobile World Congress event Telecoms.com moderated a panel discussion hosted by Mavenir with the aim of providing a status update on Open RAN.

Scott Bicheno, Editorial Director of Telecoms.com

Open RAN has reached an inflection point. The initial hype has subsided and the concept has evolved. Where once the focus was purely on radio access network supplier diversity, and all the presumed benefits increased competition is presumed to bring, the Open RAN proposition is now more nuanced.

So MWC 2025 was the perfect time and setting to gather representatives of the operator, vendor, analyst and journalist worlds to throw ideas around in a panel discussion, with the aim of defining what Open RAN means to the industry now.

The panellists were: Joe Madden, Founder and Chief Analyst at Mobile Experts; Rob Soni, VP of RAN Technology at AT&T; and BG Kumar, President of Access Networks, Platforms and MDE at Mavenir. We started by asking Madden to bring us up to speed on the current status of Open RAN.

Watch the Panel Discussion:

“Open RAN is multiple things,” he said. “The vision that came around five years ago was of mix-and-matching different software and hardware through open fronthaul, but it was also an open software platform where you could have applications to run on your network and customise the network.”

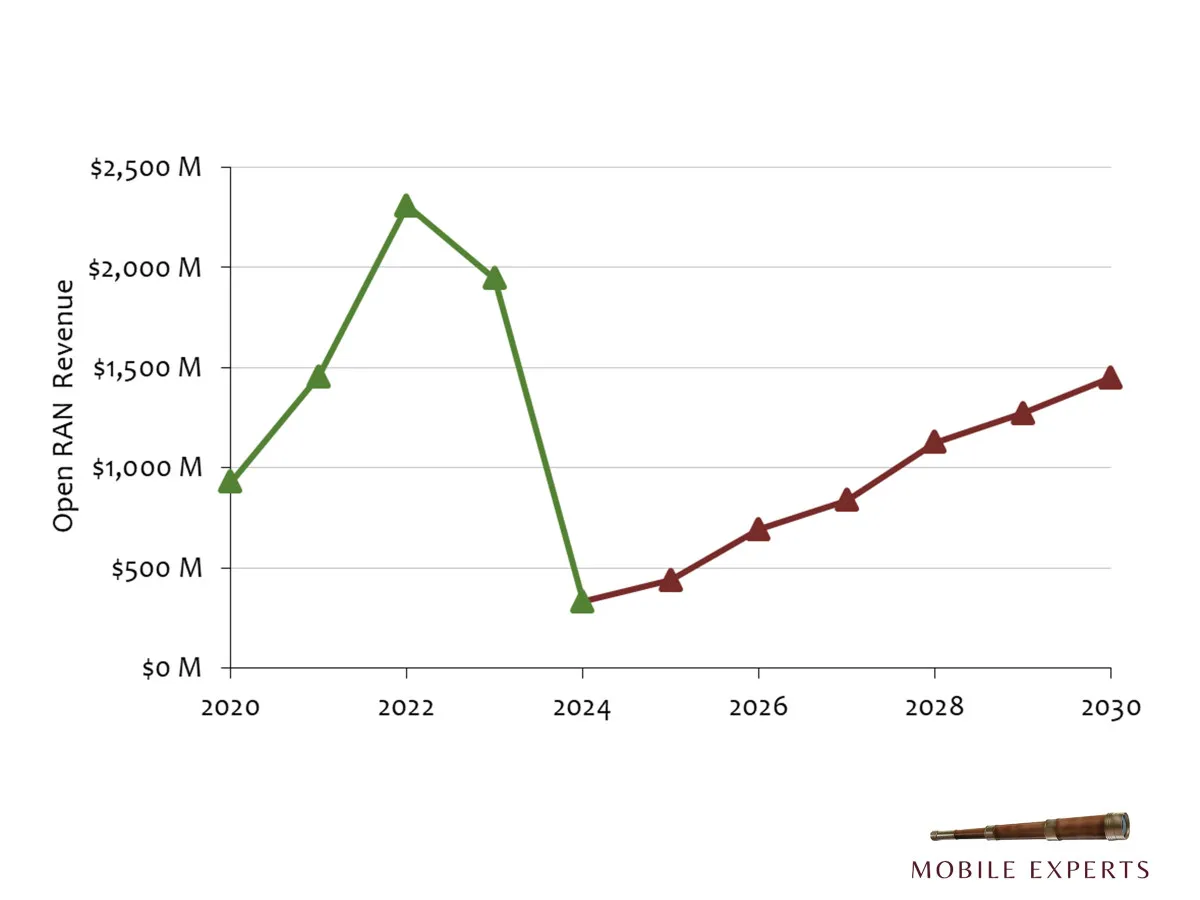

He explained that the market initially took off thanks to greenfield deployments, for which it was a low-cost, high-quality choice, but that early success was extrapolated to unrealistic ongoing revenue growth. The greenfield phase is over now and we’re into the brownfield market, which has to integrate new RAN features with legacy equipment. In some cases, such as AT&T, that has led operators to move away from the initial mix-and-match approach to having one software vendor but multiple hardware ones.

That naturally introduced Soni to offer an AT&T update. “It’s not just about TCO, it’s not just about supplier diversity, it really is finally about network programmability,” he said. “It’s about moving ourselves forward to being a truly software driven network. That’s the number one objective we have to achieve. We know software-driven parts of the network have been widely successful as rapidly bringing in innovation and breaking this classic ‘G’ cycle – the ten-year cycle that we often get stuck in.”

This is critical at a time when developments in technologies such as cloud and AI are coming thick and fast, and operators need the flexibility to incorporate them as soon as they are likely to confer benefits. Programmable networks also enable differentiated connectivity, which in turn is a great new opportunity for revenue generation for operators and was the promise of 5G.

“The only way to bring in innovation, faster speeds, and automation is to have a diverse ecosystem because that promotes competition,” said Kumar. “Different companies have different skill sets and in an open ecosystem you can pick the best of breed.”

The introduction of that diverse ecosystem, however, is not straightforward. “The cycle in this industry is pretty long,” said Madden. “You put equipment in the field and it’s unlikely you’re going to tear it out and put Open RAN in to save money. You wait for an opportunity at the end of the lifecycle for one product, or maybe you have new spectrum coming out, and that’s your chance to invest. A lot of operators have deployed their 5G networks without Open RAN and now they’re looking for that next opportunity.”

Madden noted that AT&T had been one of the more proactive operators in terms of Open RAN investment, so we asked Soni why that was. “We had a lot of experience in the disaggregation of hardware and software in the network,” he said. “We started in the transport side, which is a hard area to disaggregate. The hardware and software layers are now fully disaggregated in the 5G SA core implementation we have. So we see that as the jump off point to say disaggregation needs to come, whether it’s for cloud RAN or even for network management.”

This led to discussion of rApps, which are new pieces of software that are used for automated RAN management. Kumar noted that the introduction of rApps is a great example of what having a truly open, programmable network enables. “Initially, when Open RAN came about, it was completely disaggregated networks so every component can be separate,” said Kumar. “But what I see more and more, especially with the brownfield operators, is that they’re not focused on the disaggregation to that level.

“What AT&T is doing is brilliant – they’re starting with a common baseband but bringing in different radio vendors, which is a more practical way to bring new vendors into a very complex network. More and more I see operators using the principles of Open RAN, focusing more on automation and AI-based new services.”.

Both Madden and Soni spoke of an eight-year network investment cycle and the latter explained how supplier diversity has had a positive effect on the total cost of ownership. “We got a very good TCO benefit by migrating from legacy, appliance-based network management,” said Soni. “We got a very good TCO benefit by bringing in new radio vendors, because one of the things we struggled with a lot was that the radios we were looking for, especially for densification, had somewhat unique requirements.”

“The other half of the ROI equation is new revenues and this flexibility that comes out of an open system allows them to automate the network, to implement things for enterprises that they might have taken longer to get done before,” said Madden. “That flexibility is going to allow AT&T to go after large enterprises and offer them something for premium performance for a premium price. It’s going to boost the revenue of the industry and that, in the longer term, might be an even more important component to the ROI.”

To conclude we asked the panel what they want the audience to take away from this discussion. Kumar explained that Open RAN operates within operator refresh cycles and, as those cycles come in, Open RAN adoption will really pick up. Another driver of Open RAN demand will be the refarming of spectrum.Soni stressed again that it’s all about network programmability and how that will enable innovation at a much more rapid pace.

Madden mentioned the Mobile Experts chart below showing the greenfield market growing and then coming down, followed by the brownfield market then growing more steadily. He concluded by noting that technology markets tend to consolidate down to a small number of operating systems that support march larger hardware and software ecosystems, and that’s what’s happening to the RAN market too.

This article has also been published on Telecoms.com: A discussion of the current status of the Open RAN market